- #Monthly family cashflow spreadsheet how to#

- #Monthly family cashflow spreadsheet update#

- #Monthly family cashflow spreadsheet full#

- #Monthly family cashflow spreadsheet plus#

- #Monthly family cashflow spreadsheet download#

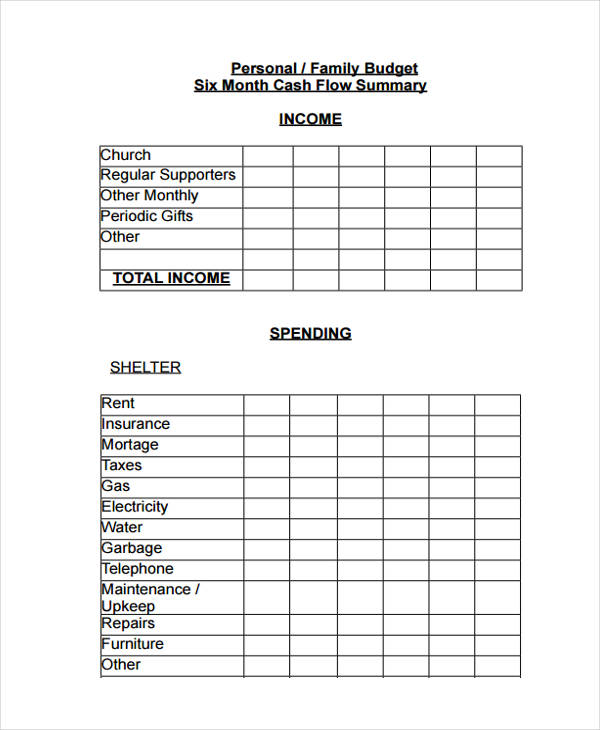

Again, the “DIFFERENCE” column will automatically populate. Go through each category and fill out the “ESTIMATED” and “ACTUAL” sections. This tab is just to the right of the “Income Input” tab, and clicking it should bring up a list of expense categories including bills, transportation, entertainment, child-raising expenses, and more. Next, you’ll need to click on the “Expense Input” tab at the bottom of the sheet. Filling these columns out will automatically complete the “DIFFERENCE” column and show you your total income. You’ll need to fill out both the “ESTIMATED” and “ACTUAL” columns. This includes various income sources such as your regular paycheck, earnings from investments, bonuses, and more.

#Monthly family cashflow spreadsheet full#

Here you’ll see the full list of income categories. Start by clicking on the “Income Input” tab at the bottom of the spreadsheet.

#Monthly family cashflow spreadsheet download#

To start, you’ll need to click the “Download” button to download our simple monthly budget template, then open it with Microsoft Excel or Google Sheets. Our simple budget template uses categories for your income and expenses, which you can use to track how much money is coming in and going out each month. Get Started Today Budgeting Using a Simple Budget Template

#Monthly family cashflow spreadsheet how to#

#Monthly family cashflow spreadsheet plus#

#Monthly family cashflow spreadsheet update#

Update your cash flow forecast weekly with actual figures. Keep your cash flow forecast extending 12 months out at all times. Use your cash flow projection to anticipate your working capital needs and plan ahead for upcoming expenses so you don’t run out of money. This can happen if you have more money going out than coming in or if your customers don’t pay you for 30, 60, or 90 days. It’s possible to have lots of revenue coming in and still not be able to pay your bills. In fact, as a startup, you should know how much cash is in your business bank account at the end of each day. Regularly reviewing your cash flow statement can help you avoid this fate. Cash flow problems are a common cause of small business failure. How to Use a Cash Flow Statementįor a new business owner, every dollar of startup capital is precious. Subtract cash paid out from cash received, and you have your cash position for the end of the month. (This cash flow statement template includes a “pre-startup” column for cash paid out before the beginning of the cash flow statement period.)

This includes inventory and other purchases, payroll, rent, utilities, taxes, loan payments, and more. If you’ve already made some sales or received some orders, you can estimate when you will actually get paid. This might include income from sales, loan proceeds, or interest income. You’ll list when you expect money to come in and when it will need to be paid out. The cash flow statement is all about projecting the future. “How can I have cash flow when my business isn’t open yet?” you may ask. (The other two are the balance statement and the profit and loss statement.) Similar to a checking account statement, the cash flow statement shows the money going into and coming out of your business.Īs a startup, you’ll need to include a cash flow statement in the financial section of your business plan. The 12-month cash flow statement is one of the three key financial statements for a business.

0 kommentar(er)

0 kommentar(er)